This article and FAQ was prepared by The Michigan Chamber of Commerce to help our members comply with Michigan’s Paid Medical Leave Act, which went into effect on March 29, 2019. It is intended to convey general information only and should not be relied on as legal advice or opinion.

This article and FAQ was prepared by The Michigan Chamber of Commerce to help our members comply with Michigan’s Paid Medical Leave Act, which went into effect on March 29, 2019. It is intended to convey general information only and should not be relied on as legal advice or opinion.

Michigan’s new Paid Medical Leave Act (“Act”) went into effect on March 29, 2019. The Act was adopted by the Michigan Legislature after a ballot proposal on the issue was certified for the November 2018 general election ballot. In adopting the proposal, lawmakers removed the proposals from the ballot (where it was all but certain to pass) and retained their ability to amend the proposals with a simple majority vote prior to the acts going into effect in March 2019. Had the issue gone to the ballot and been approved by voters, any changes would have required a three-fourths vote of the Legislature, a near impossible threshold.

The original (ballot) proposal would have required employers to give all employees 72 hours of no-notice paid sick leave per year and placed severe compliance burdens on employers, including those with paid leave policies currently in place.

The changes made by the Legislature make the law workable for employers and employees alike. The Michigan Chamber was a fierce advocate for these changes, fighting for you in the negotiating room. Our goal was to find a balance between requiring that employees have access to paid sick leave and making the law reasonable, workable and in-line with what the 10 other states with mandatory paid sick leave laws require.

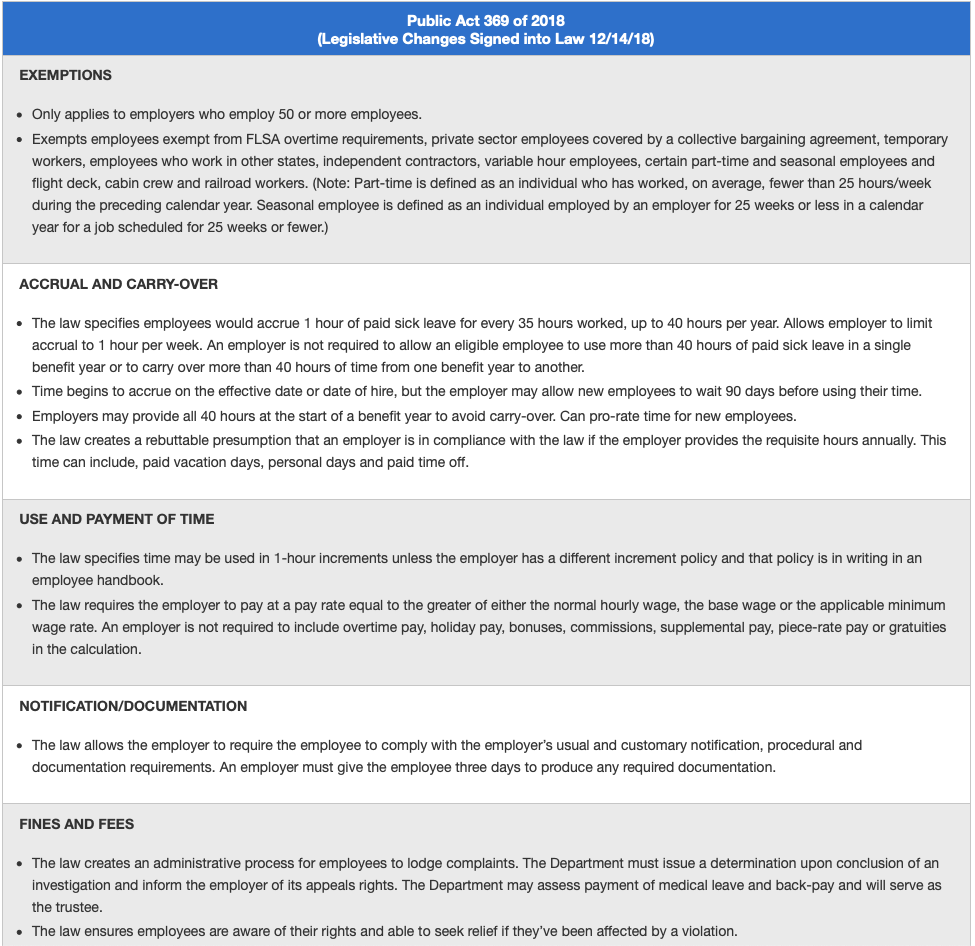

Below is a summary of the Act as signed by the Governor (Public Act 369 of 2018).

Frequently Asked Questions About Michigan's New Paid Medical Leave Act

Q. Does my business need to comply with the new law?

A. The Act applies to “[a]ny person, firm, business, educational institution, nonprofit agency, corporation, limited liability company, government entity, or other entity that employs 50 or more individuals. Employer does not include the United States government, another state, or a political subdivision of another state.” All employees must be counted in determining whether you meet the 50-employee threshold. This includes part-time and full-time employees and employees excluded from coverage under the Act.

- Counting out-of-state employees - The State has not issued guidance as to whether employees working in other states must be counted in determining whether an employer meets or exceeds the 50-employee threshold. While we know these individuals do not have to be extended the benefit, it is unclear whether they must be counted.

Q. Are all my employees eligible to accrue and use paid medical leave?

A. Not necessarily. The Act applies to “any individual engaged in service to an employer in the business of the employer and from whom the employer is required to withhold for federal income tax purposes” but the Act has 12 specific employee exemptions, including:

- An individual who is exempt from overtime requirements under section 13(a)(1) of the federal Fair Labor Standards Act, 29 USC 213(a)(1) (i.e., “any employee employed in a bona fide executive, administrative, or professional capacity or in the capacity of outside salesman”).

- An individual covered under a private sector collective bargaining agreement that is in effect.

- An individual whose primary work location is not in this state.

- An individual who is being paid the youth minimum wage or training wage under section 4b of the improved workforce opportunity wage act, 2018 PA 337, MCL 408.934b.

- Temporary employees as described in section 29(1)(l) of the Michigan employment security act, MCL 421.29.

- A seasonal employee employed by an employer for 25 weeks or fewer in a calendar year for a job scheduled for 25 weeks or fewer.

- A variable hour employee as defined in 26 CFR 54.4980H-1.

- A part-time employee who worked, on average, fewer than 25 hours per week during the immediately preceding calendar year.

- An individual employed by the United States government, another state, or a political subdivision of another state.

- An individual employed by an air carrier as a flight deck or cabin crew member that is subject to title II of the railway labor act, 45 USC 151 to 188.

- An employee as described in section 201 of the railway labor act, 45 USC 181.

- An employee as defined in section 1 of the railroad unemployment insurance act, 45 USC 351.

Q. How must time accrue?

A. An eligible employee must accrue paid medical leave at a rate of at least one hour of leave for every 35 hours worked, up to 40 hours per benefit year. An employer is not required to allow an employee to accrue more than one hour of leave in a calendar week. Benefit year is defined as “[a]ny consecutive 12-month period used by an employer to calculate an eligible employee’s benefits.” In other words, an employer has the flexibility to determine the definition of a benefit year. Different employees can have different benefits years. A benefit year can run on anniversary dates, a fiscal year, a calendar year or any other system the employer chooses.

Q. How does time accrue for eligible part-time employees? If an employee works 32 hours in one week, do we need to apply 3 hours from the next week before he or she accrues one hour?

A. Time accrues the same for all employees (1 hour for every 35 hours worked), but different employees, depending on whether they are full- or part-time, may earn their annual allotment (40 hours) at different points during the year. In other words, you get to choose how you wish to handle this scenario. For simplicity sake, you can provide part-time employees one hour for the work week. Otherwise, you can choose to carryover the time until the employee reaches 35 hours and accrues one hour.

Q. Does time accrue when an employee is on vacation or on a holiday?

A. For ease of compliance you may choose to do so, but it is not required. The Act says an eligible employee must accrue paid medical leave at a rate of at least one hour of leave for every 35 hours worked, up to 40 hours per benefit year. In other words, if they aren’t working because of vacation or a holiday, they don’t need to accrue the time.

Q. Do I have to offer more than 40 hours of leave per year? Does time carry over year-to-year?

A. An employer is not required to allow the employee to accrue more than 40 hours per benefit year but may choose to offer a more generous benefit. An employer must allow the employee to carry over up to 40 hours of unused accrued time from one benefit year to another but can cap an employee’s use of time at 40 hours per year regardless of how much time was carried over.

Q. When does an employee’s time start to accrue?

A. On the effective date of the Act (March 29, 2019) or upon commencement of the employee’s employment, whichever is later. Existing employees must be able to use time as it is accrued except for new employees, who may be required to wait until the 90th calendar date after commencing employment to begin using their time (i.e., begin accruing on day one).

Q. We front-loaded 40 hours effective January 1, 2019. Are we in compliance?

A. We currently do not have a good answer to this question and are seeking guidance from the State. The Act goes into effect on March 29, 2019 and requires time to “accrue on the effective date of this law, or upon commencement of the employee’s employment, whichever is later.”

Q. Is it true the Act allows time to be used in one-hour increments?

A. The Act allows that time “must be used in 1-hour increments unless the employer has a different increment policy and the policy is in writing in an employee handbook or other employee benefits document.” In other words, if you decide to limit use to half- or full-day increments or otherwise, you must have that policy in writing.

Q. Can I give an employee his or her time at the beginning of the benefit year?

A. Yes, and there are some benefits to doing so. The Act allows the employer to provide all 40 hours of leave at the beginning of a benefit year (i.e., “front-load” the time). In doing so, the employer does not have to track accrual and is not required to allow the employee to carry-over leave from benefit year to benefit year. For employees hired mid-benefit year, the employer may prorate this time.

Q. Can I offer one bank of paid time off (PTO) or do I have to split out paid medical leave?

A. An employer can opt to offer one bank of PTO and that bank can include paid vacation days, paid personal days, paid medical leave and/or paid time off. If you wish to combine paid medical leave with other PTO, the employee’s time should accrue as required under the law (1 hour per 35 hours worked, up to 40 hours per year) and should be able to be used for the medical and other reasons specified under the law. We would recommend you update your employee handbook to specify that PTO includes paid medical leave as required under the Michigan Paid Medical Leave Act.

Q. For what purposes may an employee use paid medical leave?

A. Employees may take paid medical leave for the following:

- Physical or mental illness, injury, or health condition of the employee or his or her family member;

- Medical diagnosis, care, or treatment of the employee or employee’s family member; or

- Preventative care of the employee or his or her family member.

Employees may also take paid leave:

- If the employee or his or her family member is the victim of domestic violence or sexual assault;

- For the closure of the employee’s place of business by order of a public official;

- To care for a child whose school or place of care has been closed by order of a public official; or

- Because of the employee or his or her family member’s exposure to a communicable disease that would jeopardize the health of others.

Additionally, an employee can take leave:

- For medical care or psychological or other counseling;

- To receive services from a victim services organization;

- To relocate;

- To obtain legal services; or

- To participate in any civil or criminal proceedings related to or resulting from the domestic violence or sexual assault.

Q. Who is considered a “family member” under the Act?

A. “Family member,” as defined under the Act, includes “a biological, adopted or foster child, stepchild or legal ward, or a child to whom the employee stands in loco parentis”; a biological parent, foster parent, stepparent, adoptive parent, or legal guardian of an employee; a spouse; or a person who stood in loco parentis when the employee was a minor child. Family members also include grandparents; grandchildren; biological, foster, and adopted siblings; and any person to whom the employee is legally married under the laws of any state.

Q. What do I do if I give an employee 40 hours of PTO on Jan. 1 and the employee uses all his or her time for vacation but later in the benefit year needs to use sick time?

A. Arguably, under this scenario, you have complied with your obligation under the Act, even if the employee used the available time for medical or other reasons not covered by the Act. It is worth noting that, depending on the situation, you may have additional obligations under the federal Family Medical Leave Act and/or other statutes and should consider consulting an attorney.

Q. How do we handle employees who may work 24 hours one week and 30 hours the next?

A. The Act says the benefit does not need to be provided to an “individual who worked, on average, fewer than 25 hours per week during the immediately preceding year.” You will need to look back to the previous year to determine eligibility. For new employees (i.e., individuals with no year to look-back to), we would recommend keeping those employees under 25 hours per week for a full year if you wish for the coverage exclusion to apply.

Q. How is the pay rate calculated?

A. The Act requires an employer to pay an employee at a pay rate equal to the “greater of either the normal hourly wage or base wage for that eligible employee or the minimum wage rate” ($9.45/hour as of 03/29/19). An employer is not required to include overtime pay, holiday pay, bonuses, commissions, supplemental pay, piece-rate pay or gratuities in this calculation.

Q. Can I require an employee to call-in or provide other advance notice? What about a doctor’s note?

A. Yes, the Act requires an employee, “when requesting to use paid medical leave, [to] comply with his or her employer’s usual and customary notice, procedural, and documentation requirements for requesting leave.” If you wish to require advance notice, your policy should be in writing and your expectations should be clearly communicated to all employees. As for a doctor’s note, employers are free to set their own policies. While you don’t have to wait to ask for a doctor’s note, the Act specifies that an employer “shall give an eligible employee at least 3 days to provide the employer with documentation.”

Q. What about employees who chronically abuse our policy?

A. The Act “does not prohibit an employer from disciplining or discharging an eligible employee for failing to comply with the employer’s usual and customary notice, procedural, and documentation requirements for requesting leave.”

Q. Do I have to compensate for unused time?

A. No. The Act “does not require an employer to provide financial or other reimbursement to an eligible employee for accrued paid medical leave that was not used before the end of a benefit year or before the eligible employee’s termination, resignation, retirement, or other separation from employment.” Time does not need to transfer if the employee is transferred to a separate division, entity or location. If there is a separation and subsequent rehire, an employer is not required to allow the employee to retain previously accumulated time.

Q. Do I have record keeping requirements?

A. Yes, an employer is required to retain records for not less than one year “documenting the hours worked and paid medical leave taken by eligible employees. Those records shall be open to inspection by the [state] at any reasonable time.”

Q. Can I be sued for noncompliance? What are the penalties?

A. There is no private right of action under the Act. All complaints must be filed with the State of Michigan (Department of Licensing and Regulatory Affairs [LARA]) within six months of the alleged violation. LARA will investigate and attempt to mediate the claim. If informal resolution is not successful, the department may impose penalties and grant an eligible employee or former employee payment of medical leave improperly withheld. The department’s determination may be appealed by either party. If LARA finds a violation of the Act has occurred, they may recover payment of the improperly withheld paid medical leave and may impose civil fines of not more than $1,000.

Q. Are there poster requirements?

A. Yes, like the minimum wage law, employers must display conspicuously at their places of business a poster that contains the amount of paid medical leave required to be provided under the Act; the terms under which paid medical leave may be used; and the employees’ right to file a complaint with the Michigan Department of Licensing and Regulatory Affairs (LARA) for any violation of the Act. LARA may impose civil fines of not more than $100 for each willful violation of an employer’s posting obligations.

Used with permission of The Michigan Chamber of Commerce.